Life insurance policy loans can be a great option for policyholders who need quick access to cash. However, it’s important to remember that a policy loan is a loan and will have to be paid back with interest. As a policyholder, it’s essential to understand the ins and outs of taking out a policy loan and how to monitor it.

Here are four tips to help you monitor your life insurance policy loan:

1. Keep track of your loan balance and interest rate

It’s essential to keep track of your loan balance and interest rate. This will help you understand how much you owe and how much interest is accruing on the loan. You can monitor this information by reviewing your policy statement or contacting your insurance company directly. By keeping track of this information, you can ensure that you’re making timely payments and not falling behind on your loan.

2. Set up automatic payments

One of the best ways to ensure that you’re making timely payments on your policy loan is to set up automatic payments. This way, you won’t have to worry about missing a payment or falling behind on your loan. You can usually set up automatic payments through your insurance company’s website or by contacting their customer service department.

Taking out a life insurance policy loan can be a great option for policyholders who need quick access to cash. However, it’s important to monitor the loan balance and interest rate, set up automatic payments, understand the impact of missed payments, and consider the impact on your death benefit. By following these tips, you can ensure that you’re making informed decisions about your policy loan and that you’re taking the necessary steps to monitor it.

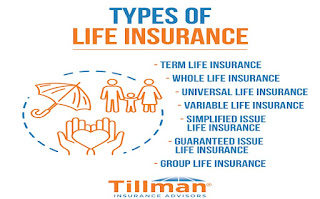

For more Information, contact Tillman Insurance Advisors.