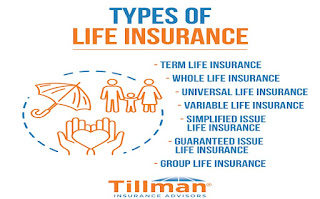

When it comes to life insurance, there are several types to choose from, each with its own unique features and benefits. Understanding the different types of life insurance can help you choose the policy that best suits your needs and budget.

Here are the most common types of life insurance:

1. Term Life Insurance

Term life insurance is the most basic type of life insurance. It provides coverage for a set period of time, typically 10, 20, or 30 years. If the policyholder dies during the term of the policy, the beneficiaries receive a death benefit. Term life insurance is generally the most affordable type of life insurance and is a good choice for those who need coverage for a specific period, such as to pay off a mortgage or to provide for children until they reach adulthood.

2. Whole Life Insurance

Whole life insurance is a type of permanent life insurance that provides coverage for the entire lifetime of the policyholder. It includes both a death benefit and a cash value component, which grows over time and can be borrowed against or used to pay premiums. Whole life insurance is typically more expensive than term life insurance but provides lifelong coverage and can be a good choice for those who want to leave a legacy or have a lifelong financial obligation.

Whether you need coverage for a specific period or want lifelong protection, there is a type of life insurance that can meet your needs. It is important to speak with our insurance agent to determine which type of life insurance is best for you, contact us at Tillman Insurance Advisors.

No comments:

Post a Comment